The ongoing tech dynamism and market upheaval unveil the upcoming rise of 3 excessive-capacity stocks set to redefine 2024. In this period of extraordinary innovation and transformative strategies, the corridors of the trio resonate with the pulse of technological evolution. Project a landscape in which synthetic intelligence (ai) reigns ideal, logistics becomes an artwork shape and innovation sparks societal exchange.

The primary inventory emerges as a colossus, strategically anchoring itself inside the AI realm and forging an open environment. The second orchestrates a tricky symphony of logistics mastery and person-centric experiences, rewriting the regulations of engagement. In the meantime, the 1/3 charts its route via the agricultural terrain, pioneering tech-driven revolutions that transcend markets and contact lives.

Study the article for an odyssey through those company titans’ maneuvers, wherein innovation meets approach, and wherein the future of commerce is being reshaped.

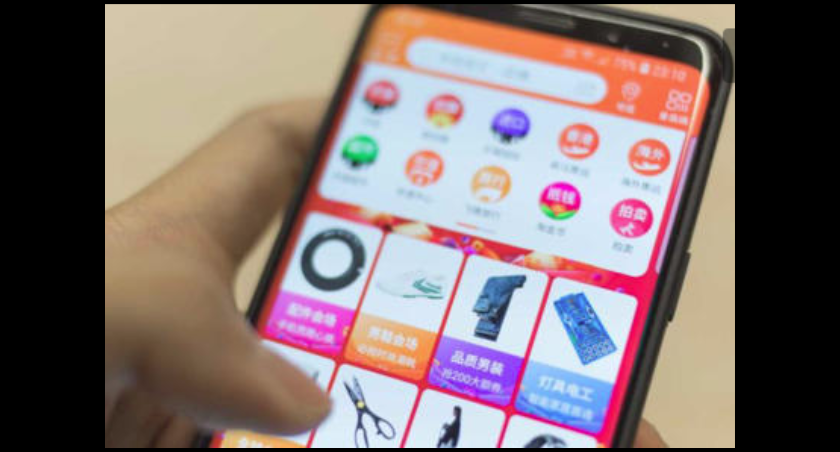

Alibaba (baba)

Alibaba (NYSE: baba) is strategically positioning itself to thrive within the AI era. The organization acknowledges a fundamental shift in computing from traditional to AI-centric. Its recognition of constructing an open cloud infrastructure and fostering open AI surroundings indicates its readiness to cater to various industries’ growing demand for AI-pushed computing.

The cloud intelligence institution additionally pursues to ramp up its ai-related software program and hardware investments. This approach is designed to capitalize on the increased capability of AI and cater to the rising call for AI-pushed services throughout industries. Alibaba stays constructive about the long-term boom possibilities pushed by using AI offerings and non-stop innovation across industries.

One of the big achievements was the exceptional 44% growth in cloud-adjusted EBITDA (q3 2023). This enhancement in profitability was in large part due to the surge in revenue from public cloud services and products coupled with operational performance improvements.

Moreover, Alibaba cloud displayed competitive advantages inclusive of pricing power, excessive renewal charges, and a highly scalable cloud computing infrastructure. The proactive method of handling the best of cloud sales resulted in enhanced profitability and a more sustainable sales shape. Strategically, the decision not to pursue the overall spin-off of the cloud intelligence group is crucial. It demonstrates a shift in consciousness from monetary engineering to operational excellence.